I understand the instruction. I have already provided the fix for the content’s beginning in the previous response, but I can present the revised text again, ensuring the Focus Keyword “Best Saving Schemes in India comparison” is prominently featured in the very first few lines, addressing the “Beginning of content” error completely.

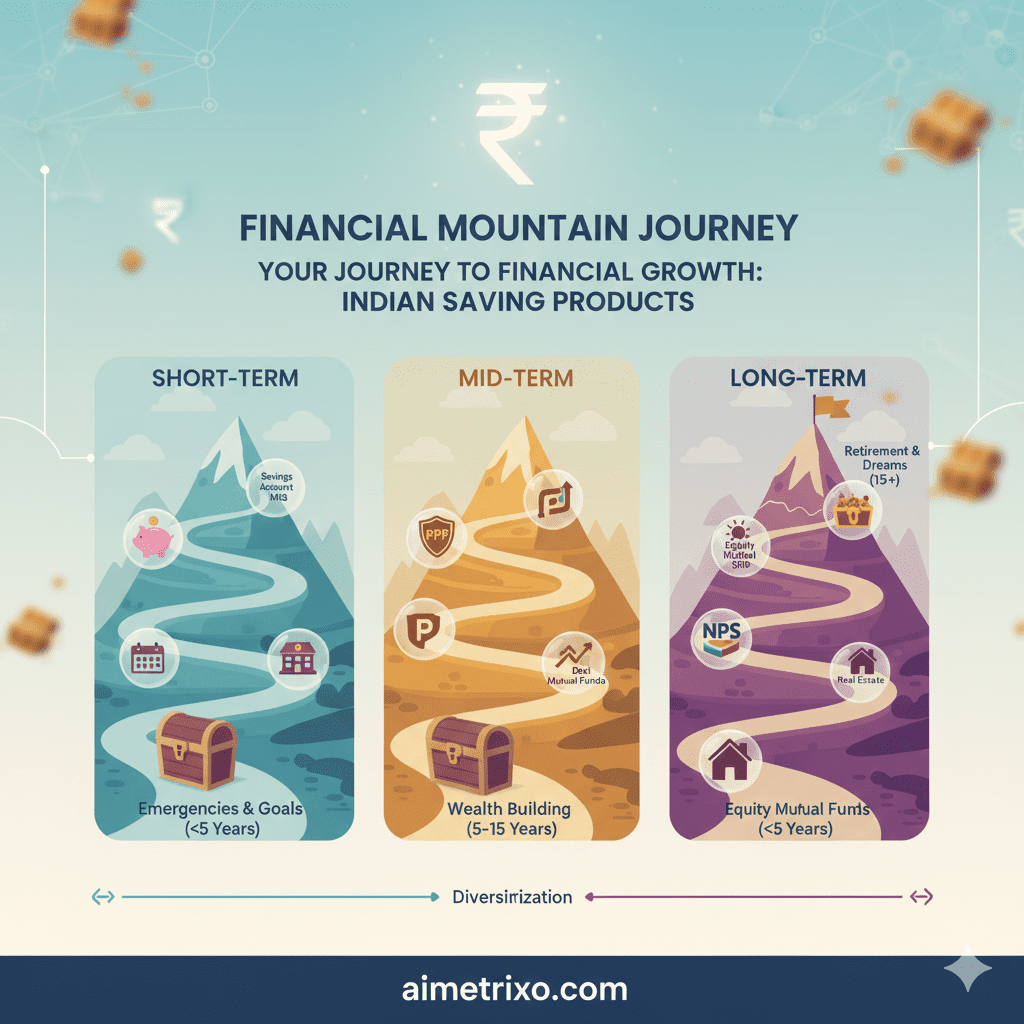

Are you searching for a Best Saving Schemes in India comparison to secure your financial future? If your hard-earned money is just sitting “lazy” in a basic salary account, it’s losing value every single day due to inflation. To combat this and create wealth, you need a clear financial roadmap.

This post will provide that comprehensive Best Saving Schemes in India comparison, breaking down the options into simple, actionable choices. We analyze bank products, government schemes (like PPF and Post Office), and market options (like Mutual Funds) to help you make the best investment choice today.

Is your money lazy?

It’s a strange question, right? But think about it. If your hard-earned money is just sitting in a basic salary account, it’s losing value every single day due to inflation. Things get more expensive every year, so your money needs to grow just to keep up.

Welcome to the ultimate guide on saving and investing in India. This isn’t for high-flying stock traders; it’s for everyday Indians who want to know: “Where should I put my extra cash to keep it safe and make it grow?” 📈

India offers a dizzying array of options—from the traditional Post Office to modern Mutual Funds. It can be overwhelming.

🔍AI in Financial Planning:

In 2025, choosing the Best Saving Schemes in India is no longer just about comparing interest rates — AI tools now play a huge role in helping Indians understand risk, predict returns, and automate investment decisions. Robo-advisors, AI savings planners, and machine-learning risk models analyze your income, age, goals, and inflation trends to recommend the best schemes. This means your saving strategy can now be smarter, more personalized, and more accurate than ever.

In this guide, we will break down the walls between complex financial jargon and simple understanding. We will compare bank products, government schemes, market options, and retirement funds to help you make the best choice for your life stage.

Let’s make your money start working for you. 💪

Table of Contents

The Big Picture: Understanding the Indian Savings Landscape 🇮🇳

Before we dive into specific products, we need to understand the different “buckets” available in the Indian market. Generally, savings and investment products fall into four main categories based on risk and who is holding your money.

🧠 AI Insight:

How AI Changes the Savings Landscape modern financial institutions in India — banks, Fintech, and even government-backed NPS/EPF platforms — have started using AI-based portfolio optimization. These algorithms can detect your risk level, compare all saving schemes instantly, and suggest a personalized investment mix.This transforms a traditional “savings comparison” into an AI-driven financial roadmap.

1. The “Safe Havens” (Fixed Income & Government Backed) 🛡️

These are products where the safety of your principal amount is the highest priority. The returns are usually fixed and predictable.

- Examples: Bank Fixed Deposits (FDs), Recurring Deposits (RDs), Post Office Schemes (NSC, KVP).

2. The “Long-Term Compounders” (Retirement & Goals) 🗓️

These are designed for long horizons (15+ years). They often have lock-in periods, meaning you can’t easily touch the money, which forces disciplined saving.

For long-term goals like retirement, this category offers the highest growth potential, significantly influencing the outcome of the Best Saving Schemes in India comparison over decades.

- Examples: Public Provident Fund (PPF), Employees’ Provident Fund (EPF), National Pension System (NPS).

3. The “Market Movers” (Growth Oriented) 🚀

These are investments, not just savings. Your money is tied to the performance of the stock or bond markets. The risk is higher—you can lose money in the short term—but the potential for long-term growth is much higher than FDs.

- Examples: Mutual Funds (Equity and Debt), Direct Stocks.

4. The “Hybrids” (Insurance + Investment) 🤝

These products combine life insurance coverage with a savings component. While popular, they are often complicated and may not offer the best returns compared to separating insurance and investment.

- Examples: Endowment Plans, ULIPs (Unit Linked Insurance Plans).

Deep Dive: Best Saving Schemes in India Comparison – The Key Products 🧐

Let’s look at the most popular tools available to the Indian saver today.

A. The Banking Stalwarts: FDs and RDs 🏦

These are the bedrock of Indian savings. You give the bank money for a fixed time, they give you a fixed interest rate. When conducting a saving schemes comparison, Bank FDs and RDs always offer the highest safety floor, making them indispensable for low-risk portfolios and emergency funds.

For those prioritizing zero risk, the traditional banking options are crucial data points in the saving schemes comparison.

- Fixed Deposit (FD): You deposit a lump sum once.

- Recurring Deposit (RD): You deposit a fixed small amount every month.

Pros: Extremely safe (insured up to ₹5 Lakhs by DICGC), easy to open, guaranteed returns. Cons: Interest rates barely beat inflation. Returns are fully taxable as per your income tax slab.

AI Tip: Many banks now use AI to calculate personalized FD tenure and optimal reinvestment cycles based on your spending pattern and inflation forecasts.

B. The Post Office Powerhouses 📮

The India Post is arguably the most accessible financial institution in the country. Their schemes are sovereign-backed (100% government guarantee), making them safer than even bank FDs.

- National Savings Certificate (NSC): A 5-year fixed savings bond. Good interest, and tax benefits under 80C.

- Kisan Vikas Patra (KVP): The “money doubler” scheme. It doubles your one-time investment in roughly 9.5 to 10 years (depending on current rates).

- Post Office Monthly Income Scheme (POMIS): You deposit a lump sum, and get guaranteed interest paid out every single month. Great for retirees needing income.

- Sukanya Samriddhi Yojana (SSY): A fantastic scheme only for the girl child (below 10 years old). It currently offers one of the highest government-backed interest rates in the country.

The tax efficiency and high interest rates offered here make the Post Office schemes a mandatory part of every Best Saving Schemes in India comparison.

The strong government backing and often high tax-free interest rates (like SSY) solidify Post Office products as highly rated contenders in any detailed Best Saving Schemes in India comparison.

AI in Government Savings: India Post is testing AI-based fraud detection and automated KYC validation to make schemes like SSY and POMIS smoother and faster.

C. The Long-Term Champions: PPF, EPF, and NPS 🏆

The Best Saving Schemes in India comparison for retirement always includes these three long-term champions, primarily due to their unparalleled tax advantages and compounding power. If you want to be a crorepati by retirement, you need these.

- Public Provident Fund (PPF): The darling of Indian savings. It has a 15-year lock-in. The interest is decent, but the magic is its “EEE” tax status: Exempt on investment (80C), Exempt on interest earned, and Exempt on maturity amount.

- Employees’ Provident Fund (EPF): For salaried employees. A portion of your salary (and employer contribution) goes here forcefully. It usually has a high interest rate that is tax-free (up to certain limits).

- National Pension System (NPS): A government-sponsored retirement scheme linked to the market. You choose how much goes into stocks (equity) and how much into government bonds. It’s low cost and excellent for building a retirement corpus, but it has strict withdrawal rules before age 60.

AI Retirement Boost: NPS fund managers increasingly use AI models to rebalance equity and debt exposure based on market volatility — giving better long-term risk-adjusted returns.

D. The Market Grower: Mutual Funds (SIPs) 📈

This is where the modern Indian saver is moving. Instead of picking stocks yourself, you give money to a professional Fund Manager who invests it in hundreds of companies.

If your goal is truly to beat inflation and achieve significant wealth creation, the long-term data in any saving schemes comparison clearly points toward Equity Mutual Funds as the optimal choice over a 10+ year horizon.

The best way to invest here is via a Systematic Investment Plan (SIP)—investing a small, fixed amount every month automatically.

- Equity Mutual Funds: Invest mostly in stocks. High risk in the short term, high return potential in the long term (7+ years).

- Debt Mutual Funds: Invest in bonds and government securities. Lower risk than equity, slightly better returns than FDs, but not guaranteed.

AI in Mutual Funds: Several AMCs now use AI-driven stock screening, sentiment analysis, and predictive modeling to manage large-cap and hybrid funds.

Comparison 1: What Are the Returns? (The Numbers Game) 🔢

One of the biggest questions is: “How much will I get?” Below is a crucial data point in your Best Saving Schemes in India comparison—a table giving you approximate current interest rates/returns.

Below is a comparison table giving you approximate current interest rates/returns.

Disclaimer: Rates change frequently. These are indicative ranges for 2025. Market-linked returns are based on historical long-term averages, not guarantees.

| Product Category | Specific Product | Approx. Interest / Rate of Return (p.a.) | Risk Level | Taxable Returns? | Liquidity (How easy to get cash out) |

| Banks | Savings Account | 2.5% – 4% | Very Low | Yes | Very High |

| Fixed Deposit (FD) | 6.5% – 7.5% (Higher for Seniors) | Very Low | Yes (As per slab) | High (With penalty) | |

| Post Office | POMIS (Monthly Income) | ~7.4% | Very Low | Yes | Medium |

| NSC (5 Year) | ~7.7% | Very Low | Yes (But reinvested) | Low (5 yr lock-in) | |

| Sukanya Samriddhi (SSY) | ~8.2% | Very Low | No (EEE Status) | Very Low (Until girl is 18/21) | |

| Retirement/Govt | PPF | ~7.1% | Very Low | No (EEE Status) | Very Low (15 yr lock-in, partial allow) |

| EPF (Salaried) | ~8.15% | Very Low | Mostly No | Low (Until retirement/job loss) | |

| NPS (Market Linked) | 9% – 12% (Historical Avg depending on equity choice) | Medium | Partially Taxed at maturity | Very Low (Until age 60) | |

| Market Linked | Debt Mutual Funds | 6.5% – 8% | Low/Medium | Yes (Capital Gains tax) | High |

| Equity Mutual Funds (Long term) | 12% – 15% (Historical Avg) | High | Yes (Capital Gains tax) | High |

💡 Key Takeaway: If you want safety and tax-free returns, PPF and SSY are unbeatable. If you want to beat inflation significantly over 10 years, you must consider Equity Mutual Funds.

Comparison 2: The Right Product for Your Age 👴👵👶

A 25-year-old should not be saving the same way as a 65-year-old. Your ability to take risks changes with age.

- Young Earners: Can take risks because they have time to recover from market crashes. Focus on growth.

- Middle-Aged: Need a balance of growth for retirement and stability for kids’ education.

- Seniors: Need capital protection and regular income. Risk appetite is low.

To provide a complete picture, this table offers a tailored Best Saving Schemes in India comparison based on specific life stages and risk appetites.

| Age Group | Primary Financial Goal | Risk Appetite | Recommended “Must Have” Products | Also Consider | Avoid / Minimize |

| 20s – 30s (The Accumulators) | Building an emergency fund, saving for a house/car, starting retirement corpus early. | High | 1. Term Life Insurance 2. Equity Mutual Funds (SIPs) 3. EPF (if salaried) | NPS (for extra tax saving), PPF (as debt cushion) | Traditional Insurance Plans (low returns), too much cash in savings account. |

| 30s – 40s (The Balancers) | Kids’ education, home loan repayment, boosting retirement savings. | Medium-High | 1. Equity Mutual Funds 2. PPF 3. SSY (if you have a daughter) | NPS, Debt Mutual Funds | Getting into new, complex schemes without understanding. |

| 50s (The Pre-Retirees) | Consolidating wealth, ensuring retirement kitty is safe, planning for medical costs. | Medium-Low | 1. Maximize PPF/EPF 2. Shift Equity to Debt MFs slowly 3. Health Insurance Top-up | NPS (shifting to conservative mode) | Starting risky new equity investments. |

| 60+ (The Golden Years) | Regular monthly income, capital protection, liquidity for medical emergencies. | Low | 1. Senior Citizen Savings Scheme (SCSS) 2. Post Office MIS 3. Bank FDs (Senior rates) | Debt Mutual Funds (for better tax efficiency than FD) | High-risk stocks, long lock-in products. |

Market Trends: Where is India Investing? 📊

It’s helpful to see what other savers are doing. The Indian financial landscape is shifting rapidly from physical assets (gold, real estate) to financial assets.

Understanding market preference is essential. When looking at household asset allocation, the data provides a clear picture of shifting priorities in the Best Saving Schemes in India comparison.

The Trendlines Indicate:

- The Rise of the SIP: The Mutual Fund Systematic Investment Plan (SIP) has become a household name. Indians are now pouring thousands of crores every month into equity markets via SIPs, realizing that FDs alone won’t cut it.

- NPS Traction: With the government offering extra tax benefits (an additional ₹50,000 under 80CCD(1B)), many young professionals are adopting NPS.

- FDs remain King for safety: Despite lower returns, the sheer volume of money in bank fixed deposits remains massive because of the trust factor in banks like SBI, HDFC, and ICICI.

Real-Life Scenarios: Understanding with Examples 🧑💼👩⚕️👨🌾

Let’s see how these products work in real life for different people.

Example 1: Rahul, The 26-Year-Old Software Engineer 💻

Rahul just started his career. He wants to buy a car in 5 years and save for retirement.

- The Mistake: He puts all his savings in a bank Recurring Deposit (RD).

- The Better Path:

- For the Car (5 years): He should use a mix of RDs (for safety) and a conservative Hybrid Mutual Fund. The RD guarantees some capital, the Hybrid fund tries to beat inflation.

- For Retirement (30+ years): He should start an aggressively equity-focused NPS or an Equity Mutual Fund SIP. His decision in the Best Saving Schemes in India comparison must prioritize growth over immediate safety.

Example 2: Priya and Amit, Parents of a 4-Year-Old Daughter 👨👩👧

They want to secure her future education expenses, needed in about 14 years.

- The Must-Do: Open a Sukanya Samriddhi Yojana (SSY) account immediately. It offers the highest government-backed tax-free return. This forms the safe foundation of her education fund.

- The Booster: Alongside SSY, start an SIP in a diversified Equity Mutual Fund. Over 14 years, combining the security of SSY with the growth of Mutual Funds offers a balanced solution in this saving schemes comparison for children’s education.

Example 3: Mr. Sharma, The 62-Year-Old Retiree 👴

He just received his retirement lump sum. He needs ₹30,000 per month to run his house.

- The Strategy: For retirees, the saving schemes comparison leans heavily toward safe, income-generating products like the Senior Citizen Savings Scheme (SCSS) and Post Office MIS. He should max out the SCSS…

- He should max out the Senior Citizen Savings Scheme (SCSS) at the bank or post office (currently ₹30 Lakh limit) for quarterly income.

- Put the rest in a Post Office Monthly Income Scheme (POMIS) or Bank FDs with monthly payouts.

- Keep an emergency fund in a liquid savings account.

🤖 How AI Helps You Choose the Best Saving Scheme in 2025

Artificial Intelligence is transforming personal finance in India. Instead of manually comparing dozens of schemes, AI now automates the decision-making process.

1. AI-Powered Robo Advisors

Platforms like ET Money Genius, INDmoney, and Scripbox use AI to:

Analyze income & expenses

Detect your risk level

Recommend the best SIPs, NPS mix, PPF–MF balance

Auto-adjust your portfolio monthly

2.AI Return Prediction Models

Machine-learning tools calculate:

Inflation-adjusted returns

Future SIP value

Risk scores of mutual funds

Expected volatility

These insights were impossible for normal savers a few years ago.

3.AI for Tax Optimization

AI tools now tell you:

Whether to choose PPF vs NPS for tax savings

How much SIP to invest to remain in lower tax slabs

Which saving scheme gives maximum post-tax returns

4.AI Fraud Prevention in Saving Schemes

Banks, EPF portals, and even India Post use AI for:

Aadhaar verification

Transaction monitoring

Fake account detection

Auto-alerts for unusual withdrawals

The Bottom Line

Your financial plan becomes smarter, safer, and more personalized when AI assists in comparing saving schemes.

Conclusion: The Best Time to Start is Now ⏱️

There is no single winner in the Best Saving Schemes in India comparison. The best product is the one that aligns with your specific goal, time horizon, and your ability to sleep peacefully at night without worrying about market ups and downs.

Always remember to diversify. By spreading your funds across different products highlighted in this saving schemes comparison, you can balance risk and growth effectively.There is no single “best” saving product in India. The best product is the one that aligns with your goal, your time horizon, and your ability to sleep peacefully at night without worrying about market ups and downs.

- Don’t put all your eggs in one basket. (Don’t put everything in risky stocks, but don’t keep everything in a lazy savings account either).

- Start small, but start today. The power of compounding needs time to work its magic.

- If you are young, embrace some risk. If you are older, embrace safety.

Happy Saving!

Frequently Asked Questions (FAQ) on Choosing Saving Products ❓

Q1: What is the difference between Saving and Investing?

A: Saving is setting money aside for short-term goals or emergencies; the priority is safety and easy access (liquidity), like in a Savings Account or FD. Investing is putting money to work to grow wealth over the long term, accepting some risk for higher returns, like in Mutual Funds or Real Estate—these are the key drivers in a high-return focused Best Saving Schemes in India comparison.

Q2: Which government scheme gives the highest interest rate currently?

A: Currently, the Sukanya Samriddhi Yojana (SSY) generally offers the highest interest rate among small savings schemes, followed closely by the Senior Citizen Savings Scheme (SCSS).

Q3: Is my money safe in Mutual Funds?

A: Mutual funds are not guaranteed by the government. They are linked to the market. While they are regulated strictly by SEBI, your capital is at risk. However, over long periods (10+ years), diversified equity mutual funds have historically recovered from losses and provided good returns.

Q4: Should I buy insurance policies that offer money back (Endowment/ULIPs) for savings?

A: Most financial advisors recommend separating insurance and investment. Traditional “money-back” insurance policies often have very high fees and low returns (often barely beating inflation). It is usually better to buy a cheap Term Life Insurance policy for protection and invest the rest of your money in PPF or Mutual Funds.

Q5: How much emergency fund should I have and where should I keep it?

A: You should aim for 3 to 6 months of your household expenses as an emergency fund. This money should be kept in highly liquid places like a high-yield savings account or a bank Fixed Deposit that can be broken instantly via net banking. Do not lock emergency funds in stock markets or long-term schemes like PPF.

Q: How can AI help me choose the best saving scheme?

A: AI tools analyze your income, age, goals, risk profile, inflation trends, and past spending patterns to suggest the ideal mix of PPF, SSY, FDs, Mutual Funds, or NPS. They also predict future returns and rebalance your investments automatically.

Pingback: AI in Government Jobs: How 50% Office Work Will Be Automated by 2030