Table of Contents

Introduction: Unlocking the Power of Sarkari Yojanas 🔑

Are you looking for detailed information on financial support, health assurance, and welfare programs? This guide provides the complete Government Schemes of India. Every year, thousands of crores are allocated to these initiatives, yet millions of deserving families miss out simply because they lack clear information. 🤯

Whether you are an Annadata (farmer) looking for crop security 🛡️, a parent worrying about your Beti’s (daughter’s) education 📚, or a Vriddha (senior citizen) seeking dignity in old age, the Government of India has a robust financial safety net for you. 🤝

This comprehensive handbook simplifies the benefits, eligibility, and application process for the most impactful programs, ensuring the Aam Aadmi (common man) can easily claim what is rightfully theirs. Let’s explore your entitlements in this essential Sarkari Yojana List. 🌉

💡 How AI Helps:Today, advanced AI tools and digital platforms are making Sarkari Yojanas easier to access. From AI-enabled beneficiary verification to smart chatbots that guide citizens step-by-step, technology is transforming how people discover and apply for government schemes. In this article, you’ll not only learn the benefits of top schemes but also how AI is improving the delivery and transparency of these programs.

1. Government Schemes of India: for the Annadata (Farmer) 🧑🌾

Farmers are the backbone of our economy 🌾. To support them, the government focuses on income support and risk management.

A. Pradhan Mantri Kisan Samman Nidhi (PM-KISAN)

Type: Central Government Scheme 🏛️

Overview: PM-KISAN is one of the most successful Government Schemes of India providing income support to farmers.PM-KISAN is a game-changer Direct Benefit Transfer (DBT) scheme. Unlike subsidies that go to companies, this scheme puts hard cash 💰 directly into the bank account of the farmer to purchase seeds, fertilizers, or manage household expenses.

Benefits:

- Financial Support: Eligible farmer families receive ₹6,000 per year 💵.

- Installment Pattern: The amount is credited in three equal installments of ₹2,000 each, usually every four months (April-July, August-November, December-March) 📅.

- Direct Transfer: No middlemen; money goes straight to your Aadhaar-linked bank account. 🏦

Tenure: Ongoing (Annual).

Eligibility:

- All landholding farmer families having cultivable landholding in their names. 🏡

- Exclusions: Institutional landholders, farmers holding constitutional posts, retired officers with monthly pension >₹10,000, and professionals (Doctors, Engineers, Lawyers) who also farm. 🚫

Documents Required:

- Aadhaar Card (Mandatory).

- Citizenship Certificate.

- Landholding documents (Khata/Khasra numbers) 📄.

- Bank Account details.

How to Apply:

- Online: Visit-> ‘New Farmer Registration‘. 💻

- Offline: Visit your nearest Common Service Center (CSC) or the local Patwari/Revenue Officer.

🧠 AI Insight:

The government uses AI-based data verification to confirm landholding patterns and Aadhaar-bank matching, ensuring PM-KISAN money reaches genuine farmers without delay.

B. Pradhan Mantri Fasal Bima Yojana (PMFBY)

Type: Central Government Scheme 🛡️

Overview: Farming is risky. Unseasonal rains 🌧️, pests, or droughts ☀️ can destroy months of hard work. PMFBY acts as a shield (Suraksha) against crop loss. This Government Schemes of India provides the farmers with protection from such loss.

Benefits:

- Low Premium: Farmers pay a very low premium:

- 2% for Kharif crops.

- 1.5% for Rabi crops.

- 5% for commercial/horticultural crops.

- Full Coverage: The government pays the rest of the premium. If crop loss occurs due to natural calamities, the insurance company pays the claim amount directly to the farmer. 💸

Eligibility:

- All farmers growing notified crops in notified areas including sharecroppers and tenant farmers.

Application Link: pmfby.gov.in

🧠 AI Insight:

AI, satellite data, and drone-based monitoring now help assess crop loss more accurately, speeding up the claim settlement process for farmers.

2. Government Schemes of India: for Beti 👧💪

Investing in a daughter is investing in the future of two families. 👨👩👧

A. Sukanya Samriddhi Yojana (SSY)

Type: Central Government Scheme ✨

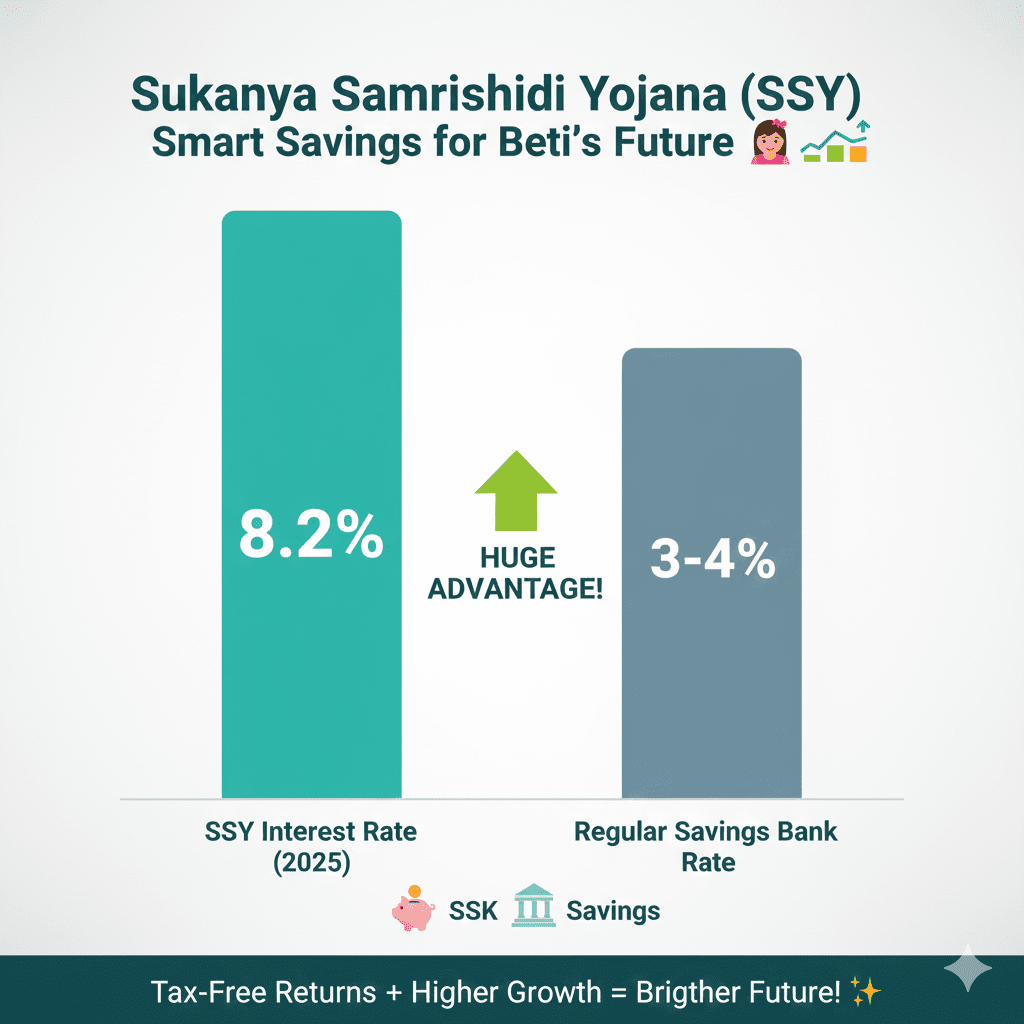

Overview: Currently offering one of the highest interest rates among all small savings schemes, SSY is a powerhouse tool for parents to save for their daughter’s higher education 🎓 or marriage 💍. SSY is a vital inclusion in the Government Schemes of India for child welfare.

Benefits:

- High Interest Rate: Approximately 8.2% per annum (subject to quarterly revision). 📈

- Tax Free: It falls under the “EEE” category—Investment is tax-deductible (80C), Interest earned is tax-free, and Maturity amount is tax-free. ✅

- Affordable: You can open an account with just ₹250.

Tenure:

- The account matures 21 years after opening. 🗓️

- Partial withdrawal (50%) allowed for education once the girl turns 18.

Eligibility:

- Parents/Guardians can open the account for a girl child below 10 years of age. 👶

- Maximum 2 accounts per family (allowed for 3 in case of twins/triplets).

Documents:

- Birth Certificate of the girl child.

- ID/Address proof of the parent (Aadhaar/PAN).

- Photographs. 📸

Where to Apply:

- Any Post Office ✉️ or authorized branches of commercial banks (SBI, PNB, HDFC, etc.).

3. Government Schemes of India: Nari Shakti= Women Empowerment Schemes 👩💪

A. Majhi Ladki Bahin Yojana (Maharashtra)

Type: State Government Scheme (Maharashtra) 🧡

Overview: Launched to provide financial independence to women in Maharashtra, this scheme acknowledges the unpaid labor women perform at home and supports their nutritional/health needs. 🍎

Benefits:

- Monthly Cash: Eligible women receive ₹1,500 per month directly in their bank accounts. 💳

- Annual Support: Total benefit of ₹18,000 per year.

Eligibility:

- Resident of Maharashtra.

- Age: 21 to 65 years.

- Family Income: Less than ₹2.5 Lakh per year 💰.

- Exclusions: No family member should be a tax-payer or government employee. ⛔

Documents:

- Aadhaar Card (linked to bank).

- Maharashtra Domicile Certificate (or Ration Card/Voter ID/School Leaving Certificate as proof of residence).

- Income undertaking/Hamipatra.

- Bank Passbook.

How to Apply:

- App: Through the official App. 📲

- Offline: Anganwadi centers or Setu Suvidha Kendras.

B. Pradhan Mantri Ujjwala Yojana (PMUY)

Type: Central Government Scheme 🔥

Overview: Smoke from traditional Chulhas is a major health hazard for rural women. PMUY provides free LPG connections to women from BPL households. 🩺

Benefits:

- Free Connection: Deposit-free LPG connection. 🔗

- Subsidy: A subsidy of ₹300 per cylinder (for up to 12 cylinders a year) is credited to the bank account.

Eligibility:

- Adult woman belonging to a BPL household/SC/ST/Antyodaya Anna Yojana.

- No prior LPG connection in the household. 🏠

Application Link: pmuy.gov.in

4. Government Schemes of India: Suraksha: Accident & Life Insurance for the Common Man 🚑

Disasters do not knock before entering. For daily wage earners or common citizens, a road accident 🚗 or sudden death can push the family into poverty.

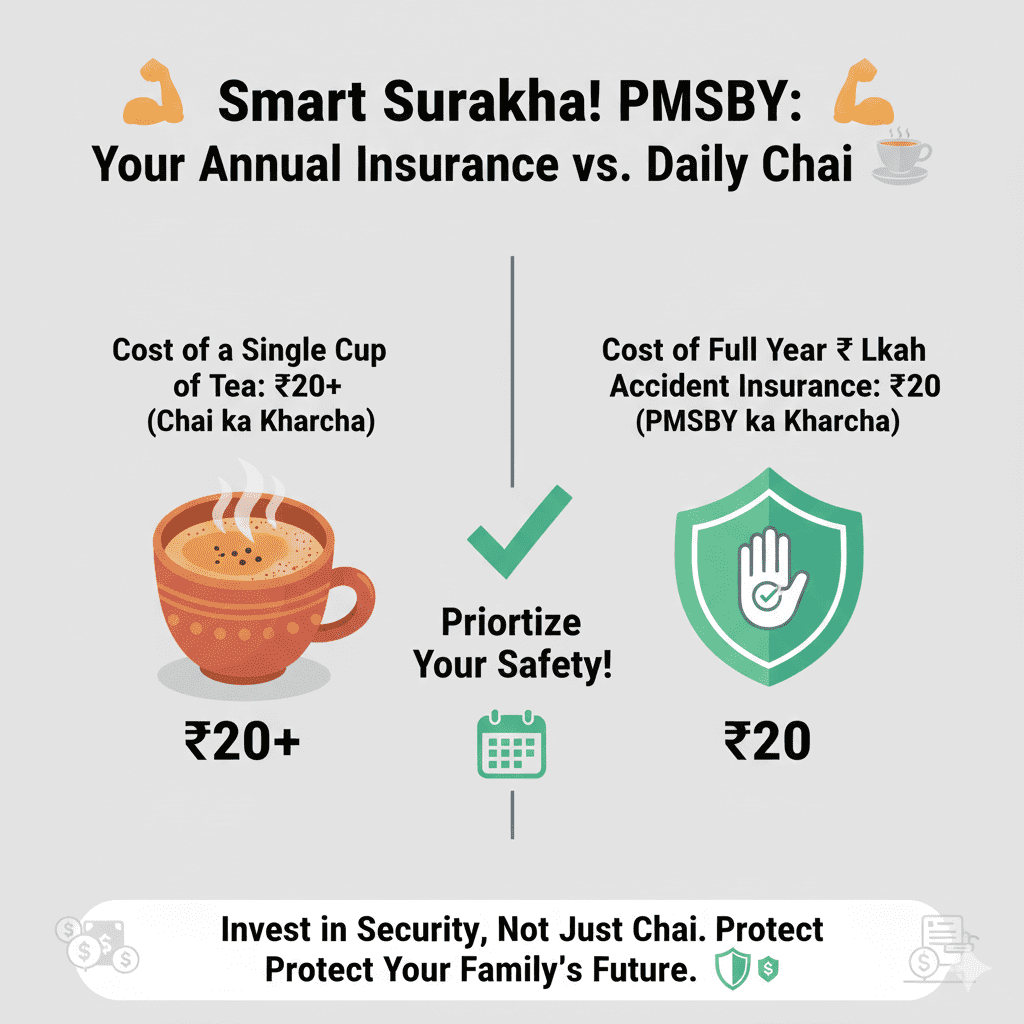

A. Pradhan Mantri Suraksha Bima Yojana (PMSBY)

Type: Central Government Scheme 🎗️

Overview: This micro-insurance plan is a foundational element in the Government Schemes of India‘s push for financial inclusion. This is an accidental death and disability insurance scheme. It is incredibly affordable, designed for the poorest of the poor.

Benefits:

- Death Benefit: ₹2 Lakh to the nominee in case of accidental death (Road accident, drowning, snake bite, lightning, etc.). ⚡

- Disability Benefit:

- ₹2 Lakh for total permanent disability (loss of both eyes/hands/feet).

- ₹1 Lakh for partial permanent disability.

- Cost: Only ₹20 per year (automatically deducted from bank account). 🪙

Tenure: 1 Year (Renewable annually).

Eligibility:

- Age: 18 to 70 years.

- Must have a Savings Bank Account.

B. Pradhan Mantri Jeevan Jyoti Bima Yojana (PMJJBY)

Type: Central Government Scheme 🕊️

Overview: While PMSBY covers accidents, PMJJBY covers death due to any reason (illness, heart attack, natural causes).

Benefits:

- Life Cover: ₹2 Lakh paid to the nominee upon the death of the subscriber.

- Cost: ₹436 per year.

Eligibility:

- Age: 18 to 50 years.

- Life cover continues up to age 55.

How to Apply:

- Log in to your Net Banking or visit your bank branch to fill the auto-debit form. ✍️

5. Government Schemes of India: for Garib Kalyan (Welfare of the Poor) : BPL & Housing Schemes 🏘️

A. Ayushman Bharat (Pradhan Mantri Jan Arogya Yojana)

Type: Central Government Scheme ❤️🩹

Overview: The world’s largest health assurance scheme. It ensures that a poor family does not have to sell their land or jewelry to pay hospital bills 🏥, This massive health program is the most critical addition to the Government Schemes of India for BPL families.

Benefits:

- Health Cover: ₹5 Lakh per family per year.

- Cashless Treatment: No money needed at the hospital. Covers surgery, medicines, diagnostics, and food during hospitalization. 💊

- Network: Valid in thousands of government and private hospitals across India.

Eligibility:

- Families identified under SECC 2011 data (Occupational criteria like rag pickers, street vendors, construction workers, etc.).

- Check Eligibility: You can check if you are eligible by visiting the portal or calling 14555. 📞

Documents:

- Ayushman Golden Card (generated at CSC or Hospital).

- Aadhaar Card.

- Ration Card.

Application Link: pmjay.gov.in

B. Pradhan Mantri Awas Yojana (Gramin & Urban)

Type: Central Government Scheme 🏡

Overview: The “Housing for All” mission aims to replace Kucha houses with Pucca homes equipped with water, toilet, and electricity. 💡

Benefits:

- Financial Assistance (Gramin): ₹1.20 Lakh (plains) to ₹1.30 Lakh (hilly areas) for house construction. 🏗️

- Subsidy (Urban): Interest subsidy on home loans (CLSS) for buying/constructing a house, ranging from 3% to 6.5% interest relief depending on income category.

Eligibility:

- Families with no Pucca house anywhere in India.

- Identified via SECC data (for Gramin).

Documents:

- Aadhaar, Bank Account, MGNREGA Job Card (for Gramin), Income Proof (for Urban).

6. Vriddha: Schemes for Senior Citizens 👵👴

Financial independence in old age is crucial for dignity. 🙏

A. Ayushman Bharat for Senior Citizens (70+) –

Type: Central Government Scheme ❤️🩹

Overview: In a major relief launched recently, the government has expanded Ayushman Bharat.

Benefits:

- Universal Coverage: All senior citizens aged 70 years and above, irrespective of their income status, are eligible. 💯

- Top-Up: If the family is already covered under Ayushman Bharat, the senior citizen gets an additional ₹5 Lakh top-up exclusively for themselves.

How to Apply:

- Registration via the Ayushman App or PMJAY portal using Aadhaar eKYC. 🆔

🧠 AI Insight:

Ayushman Bharat hospitals are integrating AI for fraud detection, faster patient verification, and better treatment recommendations.

B. Senior Citizen Savings Scheme (SCSS)

Type: Central Government Scheme 💰

Overview: A government-backed retirement savings program offered through Post Offices and banks.

Benefits:

- High Returns: Offers 8.2% interest (current rate), paid quarterly. This provides a steady income stream for retirees.

- Safety: 100% government guarantee. 🔒

- Tax Benefit: Investment eligible for 80C deduction.

Tenure: 5 Years (Extendable by 3 years).

Eligibility:

- Individuals aged 60 years or above.

- Retired civilian employees above 55 years (subject to conditions).

Documents:

- Pension Payment Order (if applicable), Aadhaar, PAN, Photos.

Quick Comparison Table: Where to Invest/Apply? ✨

| Beneficiary Category | Best Scheme | Benefit | Cost to You |

| Girl Child 👧 | Sukanya Samriddhi (SSY) | 8.2% Interest + Tax Free | Min Deposit ₹250 |

| Farmer 🧑🌾 | PM-KISAN | ₹6,000 Cash / Year | Free |

| Accident Protection 🛡️ | PMSBY | ₹2 Lakh Cover | ₹20 / Year |

| Senior Citizen 👵 | Ayushman Bharat (70+) | ₹5 Lakh Health Cover | Free |

| Women (Maharashtra) 🧡 | Ladki Bahin Yojana | ₹1,500 / Month | Free |

| Medical Emergency 🏥 | Ayushman Bharat | ₹5 Lakh / Family | Free |

General Tips for Applying 💡

- Aadhaar Linking is Key: 🔑 Almost 99% of government schemes today require your mobile number to be linked with Aadhaar, and your Aadhaar to be linked with your Bank Account (DBT Enabled).

- Beware of Fraud: 🚨 Government officers will never ask for your OTP or PIN over the phone. Official websites usually end in .gov.in.

- Use CSCs: If you are not comfortable with online forms, visit your nearest Common Service Center (CSC) or Jan Seva Kendra. They charge a nominal fee to apply on your behalf. 📍

FAQ (Frequently Asked Questions) ❓

Q1: Can I apply for PM-KISAN if I live in a city but own farm land in a village?

A: Yes, residency does not matter. If you have cultivable land in your name and are not an excluded category (like an income tax payer/professional), you are eligible. ✅

Q2: I have two daughters. Can I open Sukanya Samriddhi accounts for both?

A: Yes, you can open one account for each daughter. A third account is allowed only if the second birth resulted in twin girls. 👧👧

Q3: Is the money in PMSBY (Accident Insurance) given for natural death?

A: No. PMSBY covers only accidental death or disability. For natural death coverage, you should apply for PMJJBY (Pradhan Mantri Jeevan Jyoti Bima Yojana). ❌

Q4: How do I know if I am eligible for Ayushman Bharat?

A: You do not need to apply to become eligible; the government selects beneficiaries based on the SECC 2011 database. However, you can check if your name is on the list by visiting pmjay.gov.in and entering your mobile number. Note: For Seniors 70+, registration is now open to all via Aadhaar. 📱

Q5: What is the age limit for the ‘Ladki Bahin Yojana’ in Maharashtra?

A: Women between the ages of 21 and 65 years are eligible. 👵

Q6: Can I apply for these schemes myself, or do I need an agent?

A: You can apply for almost all these schemes yourself online or at a bank/post office. You do not need a paid agent. Using a Common Service Center (CSC) is recommended if you need help. 🤝

Conclusion

Government schemes are not just policies; they are rights designed to protect the common people of India. Whether it is the security of a pension, the safety of insurance, or the support for agriculture, these tools are available to help you live a better life. 🇮🇳

🧠 A Final Thought:

As India enters the era of Artificial Intelligence, government schemes are becoming smarter, faster, and more transparent. From AI-based verification to digital health records and automated claim approvals, technology is helping schemes reach citizens more efficiently than ever.If you want to explore how AI is reshaping India’s future, check out our latest AI articles on AIMetrixo.

🤖 How AI Is Transforming Government Schemes in India (Must-Know!)

AI is playing a major role in making Sarkari Yojanas more transparent, faster, and easier to access. Here’s how Artificial Intelligence is modernizing India’s welfare system:

✔ 1. AI-Powered Eligibility Checking

Government portals now use AI algorithms to cross-verify income, ration card details, Aadhaar data, and land records.

This reduces fraud and ensures benefits reach the right people.

✔ 2. AI Chatbots for Scheme Guidance

Many state and central websites now include AI chatbots that help citizens:

Check eligibility

Understand benefits

Track application status

Submit documents

Examples: UMANG App, MyGov chatbot.

✔ 3. AI in Crop Insurance (PMFBY)

AI + satellite imaging + drones are used to:

Predict crop damage

Speed up claim processing

Reduce human errors

This directly supports farmers under PMFBY.

✔ 4. AI for Direct Benefit Transfer (DBT) Fraud Detection

Machine learning systems detect duplicate accounts, fake beneficiaries, and false claims — ensuring transparency.

✔ 5. AI in Health Schemes (Ayushman Bharat)

AI helps hospitals to:

Detect fraud

Recommend faster approvals

Speed up patient record verification

Ayushman Bharat is integrating AI in digital health cards.

🔗 Deep Dive: Explore More AI, IoT and Resources

- AiMetrixo

- Read more: AI Tools for Development

- Explore: How AI is transforming Government Jobs

- See Also: IoT innovation that helps Farmers

Pingback: AI in Government Jobs: How 50% Office Work Will Be Automated by 2030

Pingback: The ASTOUNDING Secret: 101 Ways AI is Already Changing Your Daily Life!

Pingback: Top 25 IoT Devices Transforming Daily Life